Already a member? Click here for quick answers to your common business banking questions.

Steps to Securing

Small Business Funding

Funding is one of the biggest challenges for a new business.

Recently Jared Shintaku and Randall Gaston from our Commercial Lending leadership team had the opportunity to join the STN Community Collaborative discussion on the steps to fund a small business and the benefits of working with a local, Preferred SBA lender to help guide them through the process.

Discover a Better Way to

Start & Grow Your Business

When you bank with Arizona Financial, you'll gain access to bankers with local business knowledge.

Banking Services

Enhance and simplify your business with an expanded suite of Business and Treasury Management services.

Loan Options

Whether you're just starting out or looking to grow your business, our business team is equipped to guide your next steps.

Business Credit Card

Enjoy low rates, great rewards, and quick access to the funds your business needs.

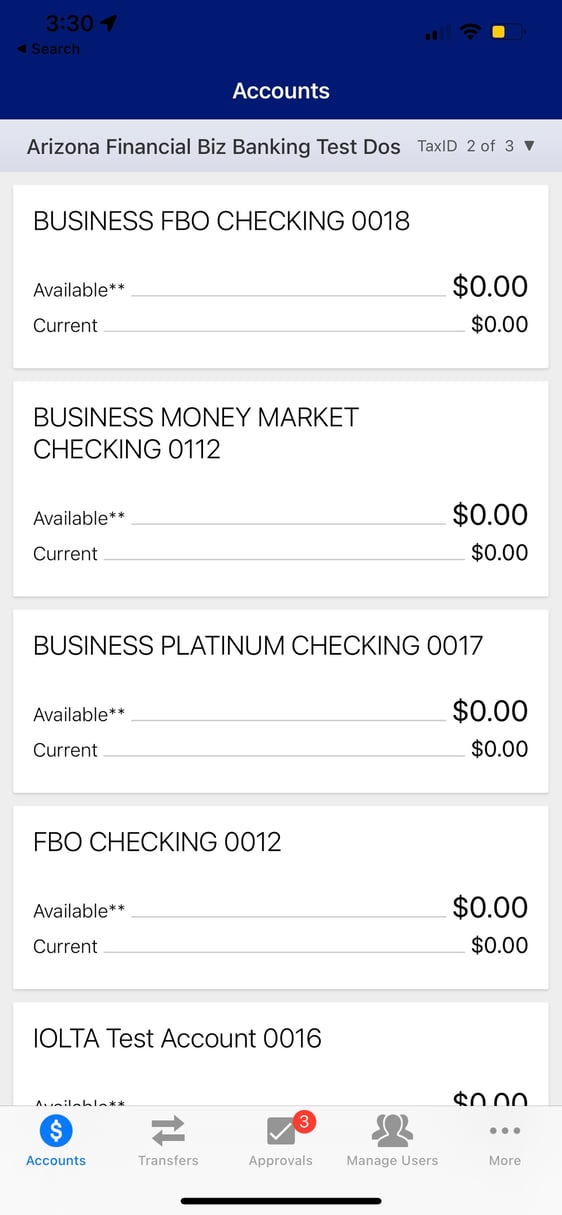

Mobile Business Banking

-

Manage Your Money

Check balances, make transfers, pay bills, deposit checks, sign up for balance alerts and more.

-

Payments and Transfers

Pay monthly and recurring bills with free Bill Pay and transfer money between eligible accounts.

-

Manage Users

Manage users and permissions for your business account.

-

Export Account Information

Automatically connect, access account information and download transactions to Quicken® and QuickBooks® using Intuit Direct Connect.

Services to Help Your

Business Succeed

-

Night Drop

Drop off daily receivables 24/7 (available at select locations).

-

Remote Deposit

Quickly deposit your checks from anywhere.

-

Safe Deposit Boxes

Ensure your valuable business items are safe (available at select locations).

-

Merchant Bankcard Services

Accept credit cards anywhere you do business. We've partnered with Elavon® Merchant Services to provide cutting-edge solutions.

Financial Resources

Treasury Management

Arizona Financial offers an expanded suite of business services to enhance and simplify your operations.

Learn MoreHow Long Will It Take To Pay Off My Credit Cards?

Use this calculator to determine the amount of time it will take to pay off your credit card balance.

CalculateBusiness Insurance Solutions

No two businesses are alike, and your insurance needs aren’t either. We'll help find the right business insurance coverage.

Learn More